Table of Content

You can’t write off electricity used for personal purposes. You can currently write off closing costs only if they’re mortgage interest or real estate taxes related to closing. Services like appraisals and title insurance can’t be written off, according to H&R Block.

Home office deductions are not available to employees. This deduction wasn't always limited to the self-employed. Employees used to be able to claim it under some strict circumstances, but that changed with 2018's Tax Cuts and Jobs Act . It was an "unreimbursed employee expenses" miscellaneous itemized deduction for taxpayers who worked for someone else, and these itemized deductions were eliminated from the tax code under the TCJA. The home office deduction is limited to your tentative net income from your trade or business. This is your overall gross income from your trade or business, less your deductible costs and expenses of doing business, not including the home office deduction.

Q5. Can the simplified method be used for one taxable year and the standard method be used in a later taxable year?

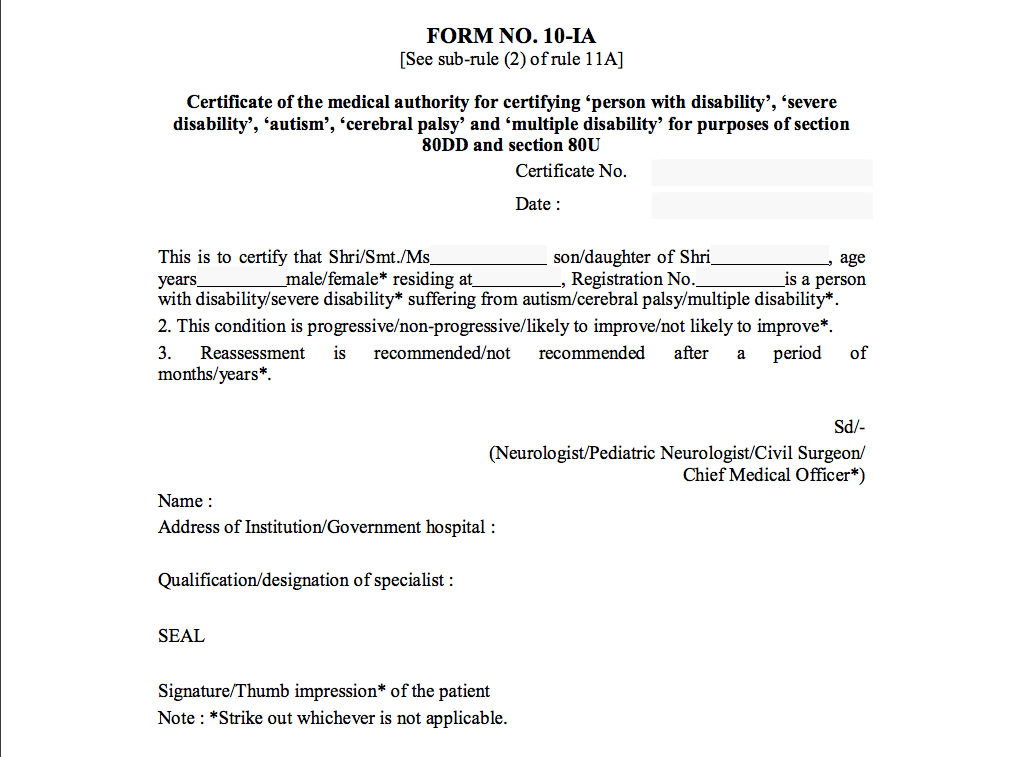

Any amount in excess of the gross income limitation may not be carried over and claimed as a deduction in any other taxable year. There are two basic requirements to qualify for the deduction. The taxpayer needs to use a portion of the home exclusively for conducting business on a regular basis and the home must be the taxpayer's principal place of business. The home office deduction is available to qualifying self-employed taxpayers, independent contractors and those working in the gig economy. However, the Tax Cuts and Jobs Act suspended the business use of home deduction from 2018 through 2025 for employees.

You have suitable space to conduct administrative or management activities outside your home. However, you choose to use the home office for those activities. You must meet or be exempt from all state licensing or certification requirements. If you don’t meet the requirements or aren’t exempt from them, you must still meet the exclusive-use test. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Qualifying for a deduction

You must use the storage area on a regular basis, and it must be suitable for storage. The law does not require you to divide your gross income between your home office and a downtown office. Further, the law does not limit the home-office deduction to the income generated from the home-office income. Deducting expenses related to a structure that is not attached but is "accessory or incident to" the home itself is the easiest standard to meet. For example, qualifying expenses of an artist's studio in a building near the home are deductible (S. Rep't No. As an example, let's say you buy professional software.

Homeowners must prorate their deductions between Schedule A of the Form 1040 tax return and their home office deduction. This applies to deductible expenses for mortgage interest, property tax, and casualty losses. To qualify as a deductible business expense, the home office must be the principal place of business or a place to meet clients. Most importantly, the taxpayer must use the home office exclusively for business.

Common Mistakes People Make When Claiming the Home Deduction

Your maximum allowed deduction is $2000, but you have $4000 in home office expenses that you still want to deduct. You can therefore only deduct up to the $2000 deduction limit and will have to carry over $2000 ($4000-$2000) to the next tax year. Now you subtract expenses related to your business activity from your business's gross income. This can include a second phone line, office supplies, and depreciation on equipment. If you use one to run your business, you may be able to take certain deductions on your taxes.

“Regular use” means you use that space on a regular basis, not just occasionally or incidentally. For example, if you use space as a home office where you go every month to pay bills, that’s regular use. But using it only once a year to prepare your tax return probably wouldn’t apply. The owner must use the space regularly and exclusively for business purposes and it must usually be their principal place of business. Taxpayers do not need to report the sale of the business portion on form 4797. However, if the business portion was a separate structure, the sale must be treated as the sale of two properties.

But spreading the cost out over several years also offers an advantage. This can reduce income tax and your self-employment tax in smaller increments over an extended period of time. It also allows you to move some of the expense to future years when you might need the deduction more. Appropriately titled the "Simplified Option," it works out to $5 per square foot of the business or office space in your home. It might save you a lot of tedious record keeping if your work space is smaller than this, but otherwise, you might be limiting your deduction to less than it could be.

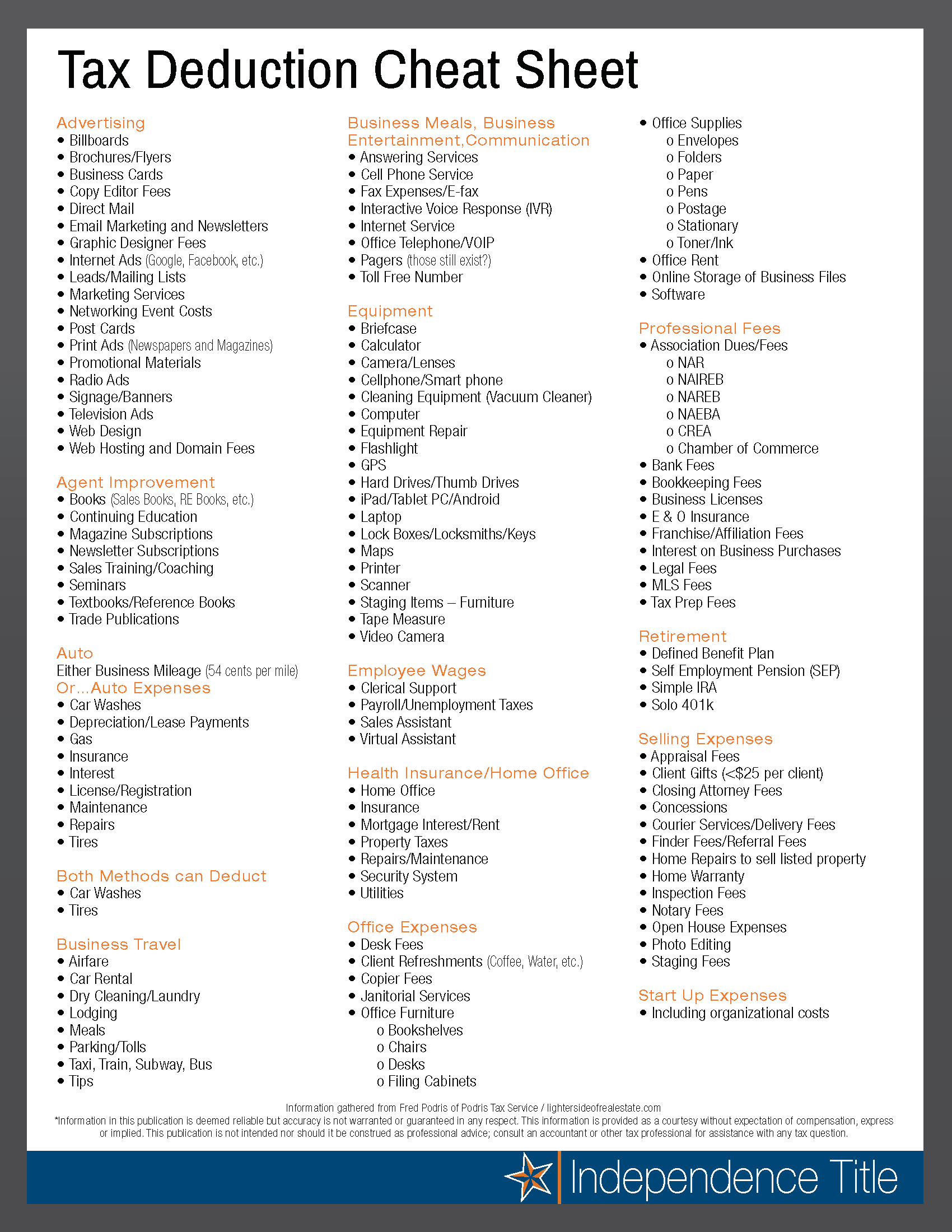

Remember, in order to claim business deductions, expenses need to be related to your business. Here is a list of common allowable office-based deductions you can claim in full on a Schedule A. Was the expense made for a non-business portion section of the home? If you spend money on expenses that were for the non-business use section of your house, none of the expenses can be written off.

The business must provide daycare for children, people age 65 or older, or people who are physically or mentally unable to care for themselves. Mrinalini is the senior investing editor at The Balance and is an expert in investing, financial journalism, digital media, and more. She's been a journalist for more than 10 years at organizations such as the Financial Times and Investopedia, and she has a master's in business and economic reporting from New York University. Erin Eberlin is a real estate and landlord expert, covering rental management, tenant acquisition, and property investment. She has more than 16 years of experience in real estate.

It's fairly easy to calculate the Simplified method for a home office deduction. Instead of keeping track of all your home office expenses, you can just measure the size of your designated home office space. The federal tax code allows home businesses to take a tax deduction for a specific space in the home where they do business.

Year-round access may require an Emerald Savings® account. If you need help handling an estate, we're here to help. Learn how to file taxes for a deceased loved one with H&R Block. For example, if you are a rideshare driver but do not have a work office and use your home office for ordering supplies, creating reports and other administrative tasks, you would qualify for the home office deduction. The IRS requires two basic conditions to claim the deduction. Here is what you need to know about deducting your home office expenses.

If the taxpayer uses an area of the home for both business and personal use, no deduction is allowed. Let’s say you are self-employed and had a net income of $9,000 from your business, which is your gross income minus expenses. During 2020, you used your home office, which was 200 square feet and your overall home’s square footage was 1,000. If you incurred the following home expenses of $8,500 for the year, you would be able to deduct 20% of your actual expenses using the actual method and claim an expense deduction of $1,700. To determine the regular method option, first, divide your home office square footage by your home’s total square footage to obtain your deductible percentage.

Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction, even if they are currently working from home. Once you have determined your deduction limit, you can then deduct any other applicable business expenses. This could include maintenance, insurance, utilities, and depreciation. Again, you can only deduct the home office percentage of these expenses, such as 10% from our example above. Expenses that relate to a separate structure not attached to the home will qualify for a home office deduction.

No comments:

Post a Comment