Table of Content

A USDA loan and a conventional loan are both a kind of mortgage you get to finance a home. Conventional just means a type of mortgage that isnt backed by the government, like FHA, USDA and VA loans. Lenders order an appraisal to determine a property’s value before finalizing your loan. This ensures they are not lending you more money than the home is worth, protecting their investment. USDA appraisals have stricter guidelines than conventional loans, which could save you from pulling the trigger on a home requiring expensive repairs. Locking in your interest rate at the right time is key, which means its important to find a lender who understands your needs and the forces that shape USDA loan interest rates.

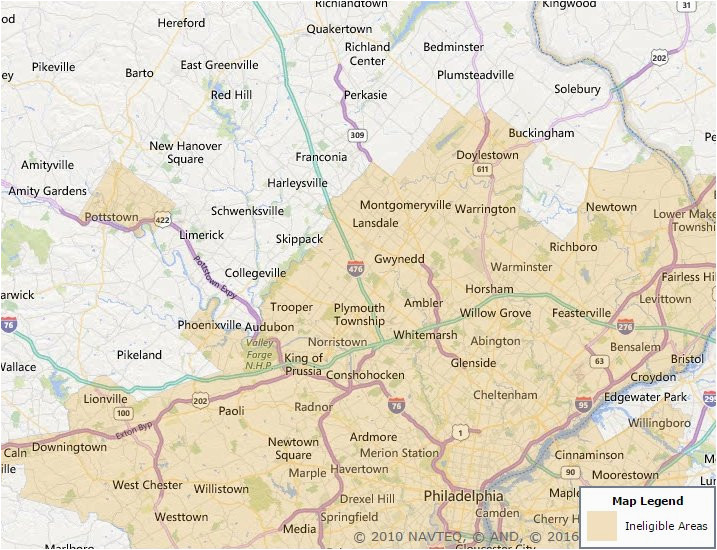

Contrary to popular belief, these loans are not just designed for homebuyers in completely rural areas — in fact, 97% of the land in the US is eligible for a USDA loan. This means even if you’re moving just outside of a city, chances are pretty high that you’re moving to a USDA-designated area. That’s great news for the increasing number of buyers looking to jump ship from crowded urban apartments to homes with more square footage and land, following the pandemic. Effective December 1, 2022, the current interest rate for Single Family Housing Direct home loans is 3.75% for low-income and very low-income borrowers.

Loan Types

As a part of USDA Rural Development, our mission is to be a cost-effective service provider that strives to help homeowners and their families remain successful homeowners throughout the term of the loan. We encourage you to comparison shop between lenders to find the best available option. If you are considering either of these types of loans, be sure to speak with a loan officer to see which one would be best for your specific situation. If you’re looking for a home loan with great benefits and flexible repayment options, a USDA Rural Development Home Loan may be right for you. The USDA Rural Development Home Loan program is an excellent option for rural homeowners who are looking for affordable financing.

You must not be suspended or debarred from participation in federal programs. After your submitted information is accepted, you will be sent an activation email. You will receive a second email requesting you to verify your Level 2 access. You can either 1) use the Online Self-Service or 2) Visit a Local Registration Authority to verify your identity.

Single Family Housing Direct Home Loans

The mission of USDA's Risk Management Agency is to promote, support, and regulate sound risk management solutions to preserve and strengthen the economic stability of America's agricultural producers. As part of this mission, RMA operates and manages the Federal Crop Insurance Corporation . Getting a mortgage after a bankruptcy or foreclosure may not be as hard as you think.

These approved lenders are also your point of contact for any questions or scenarios you wish to have reviewed for possible eligibility. Once you’ve found a participating lender, you’ll need to fill out an application and provide some basic information about yourself and your finances. The lender will then review your application and decide on whether to approve you for a loan. If you are approved, you’ll be able to get a loan that covers the purchase price of your home, as well as any necessary repairs or renovations.

What are the benefits of a Louisiana USDA Loan?

If you want to lower your payment or interest rate, though, the USDA offers three options – the streamline-assist refinance, streamline refinance and non-streamline refinance. The USDA’s definition of rural is likely looser than what you might imagine. The home must be outside of the city limits and have a small population.

Guarantees are available for mortgage loans, apartment construction or repair financing, and transitional housing loans in eligible rural areas. Packagers are encouraged to routinely visit the Direct Loan Application Packagers page for information and resources specific to packaging single-family housing direct loans. A number of factors are considered when determining an applicant’s eligibility for Single Family Direct Home Loans.

Qualifying For The Usda Rural Development Loan

The applicable very low-income limitfor the area if you have a Section 504 home repair loan. If you have an account with us and you would like to view your mortgage account information, you must first obtain a USDA level 1 Customer ID and Password, which you can do by registering below. To apply for Direct loans obtain Application Form (RD 410-4) and Release Form (RD ).

This list of active lendersis searchable by state and every effort is made by the SFHGLP team to keep this up to date. USDA Section 502 Guaranteed Loans are offered at a 30year fixed rate only. This list ofactive lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

You must prove that you made good on the debt before you can get USDA financing. In addition, you must be able to prove that you don’t qualify for any other financing, such as FHA or conventional loans. In particular, families with 1-4 family members can have a household income of up to $86,700.

However if any of these homes need work they likely won’t qualify to purchase using this program. Each program provides cost share assistance, through participating States, to organic producers and/or organic handlers. Recipients must receive initial certification or continuation of certification from a USDA accredited certifying agent . The streamline-assist refinance doesn’t require a credit check, appraisal, or proof of your income. You must, however, save at least $50 on your monthly payment to qualify. Technically, the USDA doesn’t have a maximum loan amount like the FHA sets.

At North Avenue Capital, we have assisted many business owners apply and close USDA-backed USDA Business and Industry Loans that helped them achieve their dreams and goals. We understand how these loans benefit employers and employees, who are living in rural areas and want to make a difference in their communities. We have offices in Northeast Florida, Nevada, Arkansas, Georgia, Tennessee and Texas, and are able to partner with lenders in all 50 states and US territories. Get in touch with us today to learn more about how we can help you with qualifying for a USDA B& I Loan. USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

Our associations provide real estate financing and loan options to more than 300,000 farmers and rural homeowners. From the first-time farmer or rancher, to the established farmer or rancher. USDA provides grants to local utility organizations which use the funding to establish Revolving Loan Funds . Loans are made from the revolving loan fund to projects that will create or retain rural jobs.

Over 97% of the United States is eligible for a Rural Development Loan. Any place with a population of 35,000 or less can qualify for a USDA Loan. USDA Rural Development forges partnerships with rural communities, funding projects that bring housing, community facilities, business guarantees, utilities and other services to rural America. USDA provides technical assistance and financial backing for rural businesses and cooperatives to create quality jobs in rural areas. Rural Development works with low-income individuals, State, local and Indian tribal governments, as well as private and nonprofit organizations and user-owned cooperatives. FSA makes direct and guaranteed farm ownership and operating loans to family-size farmers and ranchers who cannot obtain commercial credit from a bank, Farm Credit System institution, or other lender.

The typical costs will vary depending on location, purchase price, and overall credit profile of each borrower. In Louisiana you should typically expect between $5000-$8000 in total closing costs. While that is probably a big scary number the good news is that there are two different ways to cover these costs.

No comments:

Post a Comment