Table of Content

The typical costs will vary depending on location, purchase price, and overall credit profile of each borrower. In Louisiana you should typically expect between $5000-$8000 in total closing costs. While that is probably a big scary number the good news is that there are two different ways to cover these costs.

You must prove that you made good on the debt before you can get USDA financing. In addition, you must be able to prove that you don’t qualify for any other financing, such as FHA or conventional loans. In particular, families with 1-4 family members can have a household income of up to $86,700.

The Difference Between the USDA Rural Development Home Loan and Farm Owner Loans

CNA Template - The CNA Template Ver 1.5h should be used in lieu of all previously used versions of CNA Worksheets. The template documents the findings reached when using RD's Addendum the Capital Needs Assessment process. It includes updated estimated useful life tables and incorporates the rehabilitation guidance and miscellaneous format revisions for consistency with current program initiatives. This form has been tested and verified using the standard Windows Microsoft Excel ® to resolve compatibility issues previously reported.

This means that if you are renting land or do not own the property outright, you will not be eligible for this type of loan. Both funds aim to increase the supply of affordable housing of all tenures in rural Scotland and contribute to our 50,000 affordable homes target. FHA loan limits vary, depending on the area in which you plan to buy your home. Go to the search page for FHA Mortgage Limits, and use the pull-down menu to select the state. The next page that comes up will show the limits available for FHA insured loans, based on the type of property — single-family up to four-family dwelling.

What Is A Usda Loan

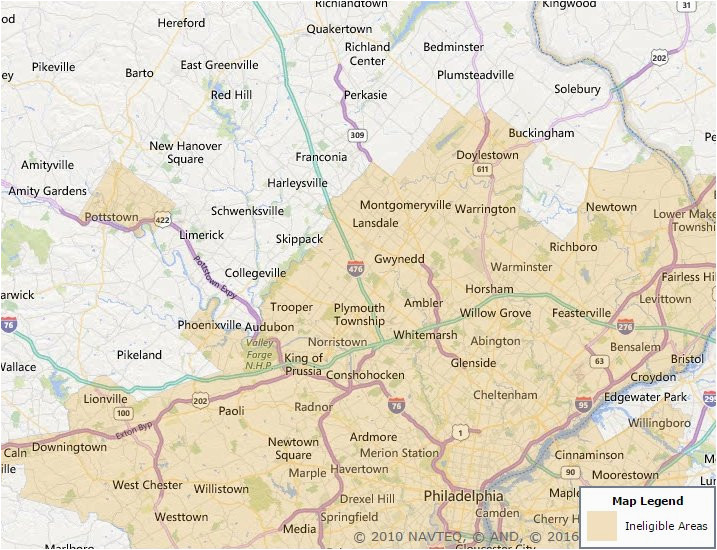

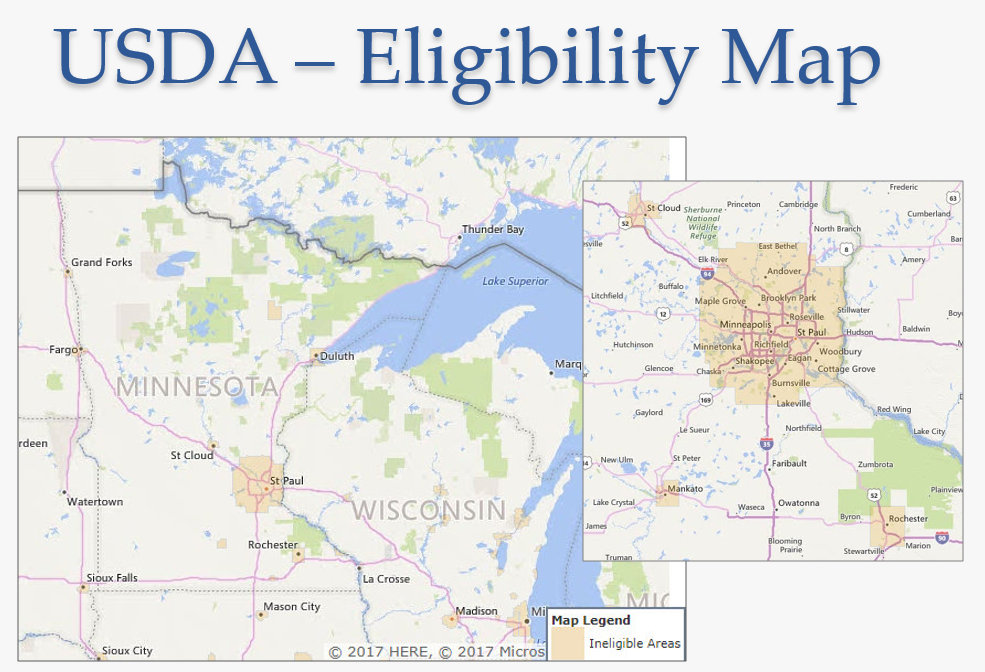

If there are additional state-specific requirements they will be listed above. The USDA loan program is also known as the USDA Rural Development Guaranteed Housing Loan Program by the United States Department of Agriculture. The USDA helps over 100,000 people a year buy homes using their cost-effective program. The FMPP was created through a recent amendment of the Farmer-to-Consumer Direct Marketing Act of 1976. To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link.

Guarantees are available for mortgage loans, apartment construction or repair financing, and transitional housing loans in eligible rural areas. Packagers are encouraged to routinely visit the Direct Loan Application Packagers page for information and resources specific to packaging single-family housing direct loans. A number of factors are considered when determining an applicant’s eligibility for Single Family Direct Home Loans.

How To Qualify For A Usda Loan

The Online Self-Service will verify your identity on-line by programmatically asking and receiving correct answers to a series of multiple choice questions that only you should know the answers to. If a conventional lender has turned you down because of your income, a USDA loan might be the right option towards homeownership. Whether you’re moving to the suburbs or the country, this federal mortgage program could save you thousands. Applications for this program are accepted through your local RD office year round. Rural Development undertakes these programs to promote rural economic development and job creation projects. Please select your state in the dropdown menu above to find your local contact for this program.

The USDA Rural Development Home Loan is available to eligible rural homeowners who are not able to obtain financing from traditional sources. These loans are like farm owner loans, but they have several key differences. Read on to learn what a USDA Rural Development Home Loan is and if it is for you. With a USDA loan guarantee, private lenders will offer mortgage loans that would otherwise not be available. Rural residents should work directly with their lender, and the lender should apply to USDA.

Pros and Cons of USDA Loans

USDA eAuthentication is the system used by all USDA agencies to enable customers to obtain accounts that will allow them to access USDA Web applications and services via the Internet in a secure manner. This includes things such as submitting forms electronically, submitting online applications and checking the status of accounts. RDApply is an application intake system that allows you to apply for loans and grants for Rural Utilities Services Programs. With RDApply, you can create an application, upload attachments, sign certifications, and draw service areas, to name a few features.

Convenience – The Internet allows customers access to information 24 hours a day and 7 days a week. Let’s find out if this rural development home-buying program is right for you. If your rural home is in need of critical repairs that are beyond what you can afford, we offer low-interest loans, as well as grants for seniors. We also finance nonprofits that can help with home repairs or water well replacements. Grants are also available to nonprofits that will provide technical assistance and training to rural communities seeking to improve housing.

The loan provides funding for the purchase or refinancing of a home and can be used for home improvements. USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan, grant, and loan guarantee programs. The programs also make funding available to individuals to finance vital improvements necessary to make their homes decent, safe, and sanitary.

At North Avenue Capital, we have assisted many business owners apply and close USDA-backed USDA Business and Industry Loans that helped them achieve their dreams and goals. We understand how these loans benefit employers and employees, who are living in rural areas and want to make a difference in their communities. We have offices in Northeast Florida, Nevada, Arkansas, Georgia, Tennessee and Texas, and are able to partner with lenders in all 50 states and US territories. Get in touch with us today to learn more about how we can help you with qualifying for a USDA B& I Loan. USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

Payment assistance is subject to recapture by the government when the customer no longer resides in the dwelling. There is no funding provided for deferred mortgage authority or loans for deferred mortgage assumptions. The program is designed to help them obtain safe, and sanitary housing in eligible rural areas. The USDA provides this by providing the application a payment subsidy in order to help with their repayment ability. The USDA Rural Development Home Loan is a government-insured loan that provides financing for rural housing. The program is available to eligible rural homeowners—not just farmers—who meet income and credit requirements.

These checklists include general instructions used in meeting the construction requirements per 7 CFR 1924 and 7 CFR 3560. The lender must also determine repayment feasibility, using ratios of repayment income to PITI and to total family debt. The program has no credit score requirements, but applicants are expected to demonstrate a willingness and ability to handle and manage debt. This program helps lenders work with low- and moderate-income households living in rural areas to make homeownership a reality. Providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas.

How Do Usda Loans Compare To Conventional Loans

USDA mortgage loans do not require a down payment, and they usually come with low interest rates. Payback periods for USDA loans may stretch to 33 years and possibly even 38 years for very low-income applicants. Under the USDA mortgage terms, the USDA guarantees 90% of the USDA loan if the borrower defaults.

No comments:

Post a Comment